Questions of trust regarding ad-tech platforms are at an all-time high.

First-party data should be questioned particularly when the numbers don’t align with universally accepted metrics, such as U.S. Census Bureau population data and media math.

This analysis conducted in Q4 2017 stemmed from a note that Pivotal Research’s Brian Wieser sent to investors, which revealed that Facebook claimed a potential U.S. reach of 25 million more adults 18-34 than the U.S. Census Bureau. This inflation is important because the data comes from their Ads Manager product, a tool that advertisers can use to plan, budget, buy and optimize their own campaign across Facebook platforms.

As former agency media planners, we set out to discover what impact this overstatement has on other aspects of an advertiser’s campaign. Therefore, we focused on two main questions:

- Is this reach inflation nationwide, or is it isolated to a few areas throughout the country?

- How does this affect an advertiser’s Facebook campaign?

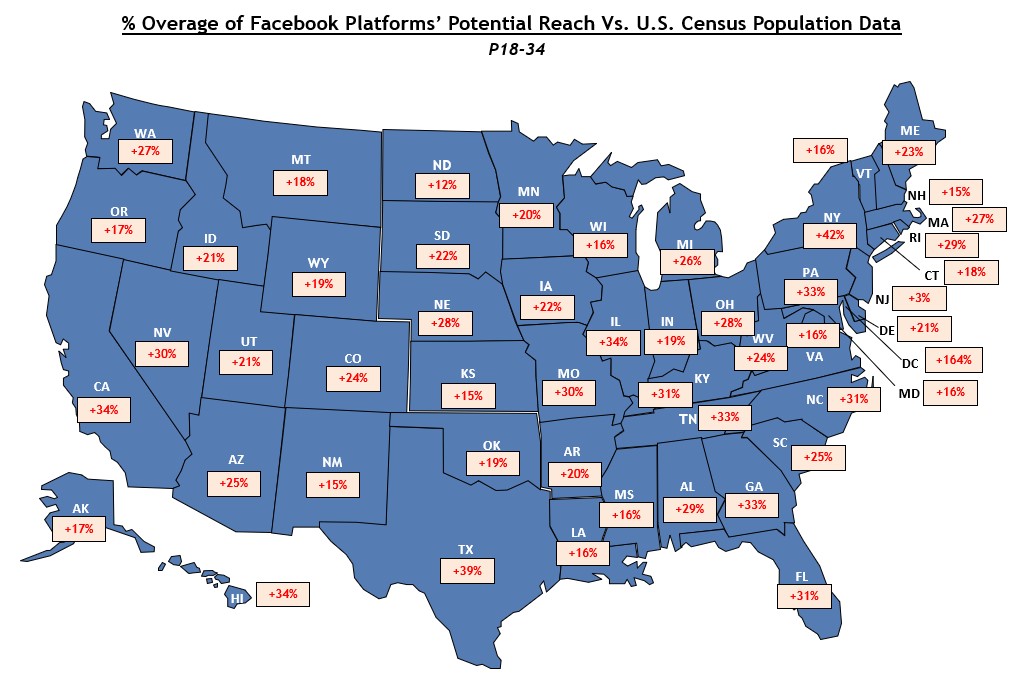

Facebook’s reach inflation affects every state

Facebook’s P18-34 reach was inflated versus the U.S. Census population in all 50 states with an average reach overage of 29%.

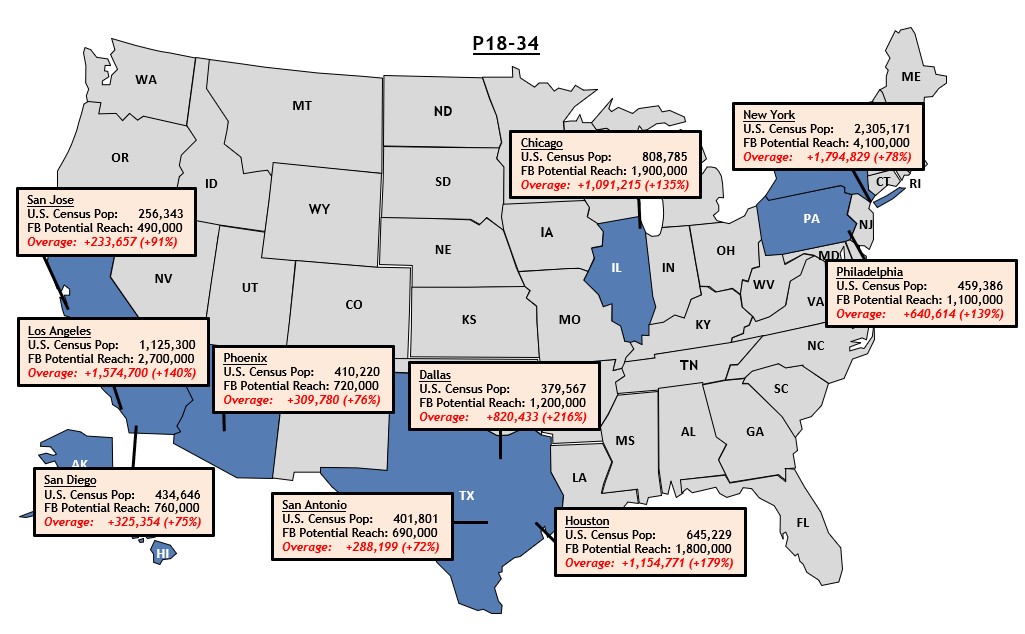

Drilling down to a city level, the average P18-34 overage was even more pronounced in major cities—New York (+78%), Los Angeles (+140%), Chicago (+135%)—and this trend exists, as well, in both mid-sized and smaller cities.

Facebook’s reach estimates break the basic laws of media math

Since Ads Manager is a campaign management tool, we developed an advertising schedule to show the potential impact that reach inflation could have on the planning of an advertiser’s campaign.

The Facebook-provided estimates, based on a sample buy, exceed the reach possible through media math:

- Reach estimates were 2x-12x higher than the expected delivery based on the buy specs.

- These estimates also reflect a very wide range of potential reach within a target (ex. 1.9MM-12MM), surprising for a platform that touts its precision targeting as a core part of their offering.

For advertisers, as you plan your campaigns, execute your schedules and evaluate your post-buy analyses across media partners, our advice continues to be the same: assume nothing and investigate everything.

Get Immediate Access To Our Content

You have questions. We have answers.

Get immediate access to our Insights library.